refinance transfer taxes florida

A pension plan for long-term workers and a defined contribution plan for shorter-service workers or people who do not plan on working for the state for more than six years. Other Situations in Florida Inheritance Laws.

Nyc Nys Seller Transfer Tax Of 1 4 To 2 075 Hauseit

Merger in 2019 gives customers the opportunity to refinance their mortgage via rate-and-term and cash-out refinance.

. Check our rates and lock in your rate. Truist which was born from the SunTrust Mortgage Banks Inc. Florida is one of the few states that does not collect income taxes.

The Florida Retirement System FRS offers two retirement plans for state employees. A deed in lieu agreement might help you move out of your home and avoid foreclosure. Jointly-owned bank accounts or homes.

There are several ways to transfer real estate title. Taxes and Insurance Excluded from Loan Terms. Mortgage Broker California and Arizona.

A deed in lieu agreement wont stay on your credit report if a foreclosure will. Retirement accounts payable-on-death bank accounts life insurance policies transfer-on-death accounts. The benefit of moving to a state with no income tax is pretty straightforward.

As far as inherited retirement accounts are concerned the heirs of such finances must pay income tax on the assets they withdraw. The Loan term is the period of time during which a loan must be repaid. It includes protections for.

ERATE is not affiliated with eRates Mortgage or Finance of America Mortgage. An FHA refinance loan is a refinance insured by the Federal Housing Association. A warranty deed promises that the person transferring the property has good title to it and the right to sell it.

For example a 30-year fixed-rate loan has a term of 30 years. Find and compare the best rates for mortgage refinance home equity personal loans and auto loans. When you take a deed in lieu agreement you transfer your homes deed to your lender voluntarily.

An Adjustable-rate mortgage ARM is a mortgage in which your interest rate and monthly payments may change periodically during the life of the loan based. Other things to know about Florida state taxes. A Fixed-rate mortgage is a home loan with a fixed interest rate for the entire term of the loan.

In exchange the lender agrees to forgive the amount left on your loan. The FRS also oversees the retirement plans for state university and community colleges and for. A warranty real estate deed transfer is the most common type of deed used when properly is sold to a third party in a typical real estate transaction.

You dont have to pay state income taxes on money you. However its state and local tax burden of 89 percent ranks it 34th nationally.

Contract To Closing Key Players And Their Responsibilities Infographic Sarasota Real Real Estate Contract Real Estate Business Plan Real Estate Training

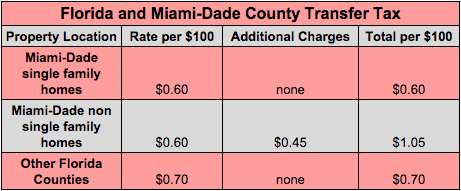

Transfer Tax And Documentary Stamp Tax Florida

Florida Intangible Tax And Transfer Tax How Do You Calculate These Closing Costs Usda Loan Pro

What Every Buyer Needs To Know About Closing Costs Home Buying Checklist Home Buying Real Estate Education

Nyc Nys Seller Transfer Tax Of 1 4 To 2 075 Hauseit

Florida Intangible Tax And Transfer Tax How Do You Calculate These Closing Costs Usda Loan Pro

Transfer Tax Alameda County California Who Pays What

Ever Wonder Who Pays What Fees In An Real Estate Closing Getting Into Real Estate Real Estate Exam Title Insurance

What Are Real Estate Transfer Taxes Forbes Advisor

The Three Most Misunderstood Tax Deductions Even For Tax Professionals Cpa Practice Advisor

1sttimehomebuyers Home Buying Credit Card Realistic

Florida Real Estate Transfer Taxes An In Depth Guide

Buyers Don T Be Surprised By Closing Cost Real Estate Fun Real Estate Infographic Real Estate Advice

Florida Intangible Tax And Transfer Tax How Do You Calculate These Closing Costs Usda Loan Pro

Nyc Nys Seller Transfer Tax Of 1 4 To 2 075 Hauseit